Protect your shipments with additional insurance!

We understand that every shipment you send holds special value — whether it’s going to customers, family, or friends. Unfortunately, even with the highest safety standards, unforeseen events can still happen — like damage, loss, or theft. While these cases are very rare, no one is completely protected from them. A lost or damaged shipment can impact both your finances and your customers’ satisfaction.

But there’s a simple way to safeguard the value of your shipment, your reputation, and your customer loyalty: shipping insurance!

All services offered by Sendparcel (except Deutsche Post, USPS, and Lietuvos Paštas) include standard insurance up to €100. However, if your shipment is valuable, we recommend purchasing additional insurance at a rate of 2% of the insured amount (with a minimum fee of €11.60 + VAT). It’s a small investment that can help you avoid potential losses.

By using Sendparcel's affordable additional insurance options, you can ensure the best delivery experience for every recipient, every time.

When sending parcels, you can never be completely certain they’ll reach the recipient safely. Sendparcel has an exceptionally high successful delivery rate (>99%), but when it comes to valuable shipments, even the smallest risk can sometimes lead to significant losses.

So, while we ensure the highest level of shipment security, parcel insurance gives customers even greater peace of mind.

How does it work?

Choose a shipping service

After entering your shipment details in the calculator, select the shipping service that best suits you. Our platform offers a wide range of services, so you’re sure to find the one that perfectly meets your needs.

Order additional insurance and ship worry-free

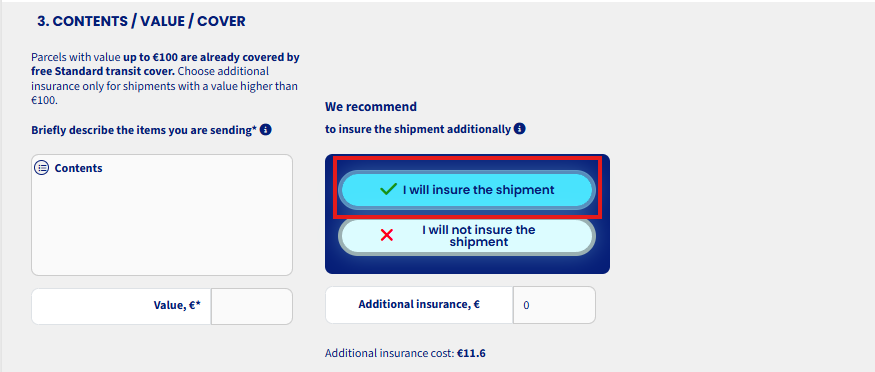

Once you’ve chosen your desired service, fill in the sender and recipient information. In the third step, you’ll describe the contents of your shipment in English and specify its value. Here you’ll also see our recommendation — to add extra protection (see the image below). This is where you can indicate the insured amount and order additional insurance, giving you peace of mind for your valuable shipment’s journey.

The shipment value and the insured shipment value can differ — the insured value may be lower than the total shipment value. This might be the case if you wish to insure only certain items within the shipment. However, the insured value cannot exceed the total shipment value.

Important to know

Restrictions: You can choose additional insurance for most of our services, except for postal services — Deutsche Post, USPS, and Lietuvos Paštas.

In case of loss or damage:

- Deutsche Post services with tracking may provide compensation up to €40,

- USPS Economy services up to €90,

- Lietuvos Paštas registered mail services up to €40, according to postal shipment regulations.

Non-compensable items: Before ordering insurance, make sure you’re not sending items that aren’t covered, as in that case the insurance won’t apply. For example, cash, jewelry, or other high-value items may not be insurable. You can check the list of insurable items here.

Shipment value and supporting documents: The shipment value is the total price of all items in the shipment as declared by the Sender at the time of ordering, based on the price paid by the Sender, and must be supported by purchase or other documents (for example, production cost estimates).

Google

Google